While some investors are already familiar with financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it matters. In a learning-by-doing approach, we’ll look at ROE to gain a better understanding of Tenet Healthcare Corporation (NYSE:THC).

Return on equity or ROE is an important measure used to assess whether the company’s management is using the company’s money effectively. In short, ROE shows the profit generated by each dollar in relation to its investment.

Check out the latest reviews of Tenet Healthcare

How do you calculate Return On Equity?

The formula for return on equity that’s it:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE of Tenet Healthcare is:

45% = US$3.5b ÷ US$7.9b (From the next twelve months to June 2024).

‘Return’ is the profit over the last 12 months. Another way to estimate this is that for every $1 of shareholder income it has, the company made $0.45 in profit.

Does Tenet Healthcare Have a Good ROE?

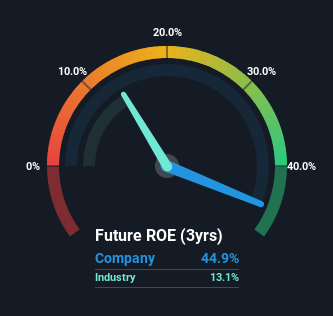

Obviously, the easiest way to evaluate a company’s ROE is to compare it to the average in its industry. Importantly, this is far from a perfect measure, because companies vary greatly within the same industry. As is clear from the figure below, Tenet Healthcare has a better than average ROE (13%) in the healthcare industry.

That’s clear. However, be aware that a high ROE does not mean good profit generation. Especially if the firm uses a high level of debt to pay off its debt that can increase its ROE but the high level puts the company at risk. Our risk dashboard should contain the four risks we identified for Tenet Healthcare.

How Does Debt Affect ROE?

Most companies need money – from somewhere – to grow their profits. That money can come from savings, issuing new shares (equity), or debt. In the first and second cases, the ROE indicates the use of capital for investment in the business. In the latter case, the use of debt will improve the return, but it will not change the equity. That will make the ROE look better than if no debt was used.

Tenet Healthcare’s Debt Consolidation And Its 45% Return On Equity

Tenet Healthcare uses excess debt to increase returns. It has a debt to equity ratio of 1.60. While there is no doubt that its ROE is impressive, we would have been even more pleased if the company had achieved this with low debt. Investors need to think about how the company would react if it could not easily borrow, because credit markets change over time.

Summary

Return on equity is a useful indicator of a business’s ability to generate profits and return them to shareholders. In our books, the best companies have the highest return on equity, despite the lowest debt. If two companies have the same ratio of debt to equity, and one has a higher ROE, I tend to favor the one with the higher ROE.

Having said that, while ROE is a useful indicator of the quality of a business, you need to look at all the factors to determine the right price to buy a stock. The rate at which profits can grow, relative to the expected growth of profits reflected in the current price, must be considered, too. So you might want to take a look at this data-rich interactive graph of the company’s forecast.

Of course Tenet Healthcare may not be the best stock to buy. So you might want to see this they are free a collection of other companies with high ROE and low debt.

Have a comment on this article? Worried about content? Catch up with us directly. Alternatively, email the drawing-team (at) simplywallst.com.

This Simply Wall St article is casual in nature. We provide explanations based on historical data and analysts’ estimates only using an unbiased approach and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and it does not take into account your goals, or your financial situation. We aim to bring you long-term focused research driven by valuable data. Note that our analysis may not result in price-sensitive or quality-sensitive company advertisements. Simply Wall St has no position in any of the stocks mentioned.

#Tenet #Healthcare #Corporations #NYSETHC #ROE #impressive